Each month, bills come around. There’s no avoiding them, and there’s no stopping them. Although many companies are opening their payment methods up to online payment options, there are still customers who prefer to pay with cash or check, or simply don’t want their credit card information online.

Pay and go kiosks are the solution to this. Not only are they easy to use, but they are also convenient for customers. The kiosks can be used internally and externally, so if the business is closed and a customer still needs to pay a bill, they can use the outdoor kiosk or go to kiosks located in a convenience store or mall — two options that are typically open past normal business hours. They are a great alternative to paying online or in-person and also work well to promote smart financial decision making. In this piece, we’ll dive into pay and go kiosks, their pros and cons, and what they can do for your business.

Pay and go kiosks: What they are and who would use them

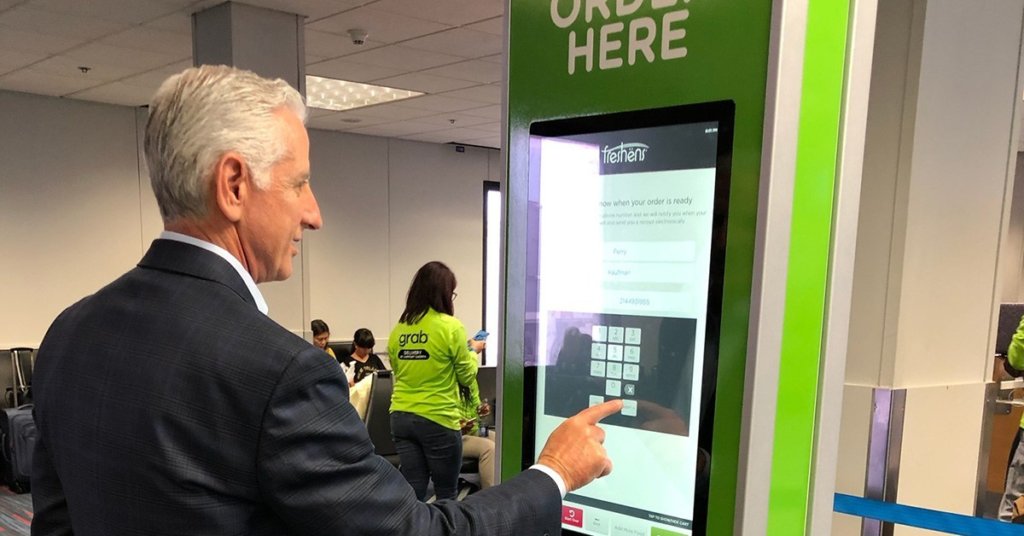

If you’ve been to a train station, a gas station, a fast-food venue or a bank, you’ve no doubt seen and used the kiosks to buy tickets, pay for fuel or food, or deposited a check. They are easy-to-use machines. Now consider those kiosks from a business owner’s point of view, and how easy they would be for your customers to use. They are simple, secure, and another option to make them happy.

The pay and go kiosk was created with the intent of making payment options easier for those needing to pay bills such as utilities, phone, loan repayments, credit cards or even insurance.

You might ask why a kiosk service is even necessary if people have the option of paying online now. The reality is that there are about 8.4 million unbanked households and about 24.2 million underbanked households in the US. This means that those people do not have sufficient access to the necessary financial services to pay their bills.

You can make life a lot easier for those needing extra assistance and more options. Equipping your business with pay and go kiosk will open your business up to a whole customer base that either does not have bank accounts or are unable to take out loans or apply for credit cards but still need to pay bills.

How pay and go kiosks work and how they’ll help your business

Quality customer service is a major tenet of running a successful business. It entails listening to the needs of your customers and implementing solutions to meet those needs. When your customers are happy, your business will profit. Pay and go kiosks provide you with an opportunity to make your customers happy by providing a convenient and accessible payment method.

The way the pay and go kiosks work is pretty straightforward. The kiosk interface allows users to choose what they’re paying and how they would like to pay. Much like an ATM, the pay and go kiosk has a check and bill scanner, a place to insert cash, a card reader, a QR code scanner, a printer and a dispenser.

So why put them in your business? Chances are, some of your current customers are part of the unbanked or underbanked population. By adding a pay and go kiosk to your store, you’re telling your customers that you understand their needs. It will keep them frequenting your business, and add some positivity around how you conduct customer service.

Similarly, if you are the owner and distributor of kiosks and you place them in businesses that those using pay and go kiosks use most, you’re giving them the chance to become more familiar with your brand. You also get to offer them services they need where they already are, such as convenience stores, groceries or malls.

Since kiosks typically accept debit and cash, you are giving your customers financial freedom they might not have elsewhere.

How do pay and go kiosks fit into the future of payments?

Paying bills can be a stressful feeling, especially when they are all due around the same time. Pay and go kiosks are accessible 24 hours, allowing customers to pay bills when and where they want.

Offering them convenience is just one more way to offer them financial freedom and peace of mind.

People can now pay bills online, in person or at a kiosk. One more option opens up another line of communication and another way to help make payments convenient. This might lead to payments being made ahead of time, fewer missed payments and less frustration on the customer’s end.

Not only that, but it’s a hassle-free option. Customers paying bills through a kiosk don’t need to go through the stress of talking with employees or cashiers. This is a big help when it comes to getting things done quicker or with less pressure. Kiosks located in many businesses in a certain location will also reduce line times in branch offices.

How you can implement pay and go kiosks

If you’re a current business owner or soon-to-be business owner, adding a kiosk to your storefront can make a big difference. It’s a great way to gain foot traffic and to add another level of commitment to quality service.

Besides foot traffic, you can use the kiosk to make some extra income as well by adding the option to purchase a prepaid phone card, for example, directly from the kiosk.

A benefit of having them in your business is that you don’t need to hire someone to work them. Working similarly to ATMs, the interface is easy for customers to use and understand. It prompts them with instructions and steps throughout the payment process.

Not having the overhead of having to hire an employee with the implementation of a payment kiosk is a great financial plus for your business. It will generate income without employment expenses.

Things to know if you are considering a pay and go kiosk

Now just because pay and go kiosks don’t require an employee to make transactions for the customer, doesn’t mean that third party interaction is completely off the table. Kiosks are made up of hardware and software that work as well as they can until they don’t. Troubleshooting might be necessary; they might be out of order some days due to a mechanical error and the software might malfunction.

This can lead to disgruntled customers who might take it out on you even though you are not the kiosk owner. This will require the kiosk owner to step in and fix the problem. The kiosk could be out for a couple of hours or it could be a couple of days, and when people grow accustomed to the convenience, they’ll go to the business owner to complain about it when it’s not there.

Besides the possibility of technical difficulties, there is the benefit that for the owners of kiosks, they are simply cheaper than owning a branch office. Branch offices are expensive to run and maintain, let alone filling with employees. To save money, there is the possibility of running fewer branches and being able to install multiple kiosks. This also means customers don’t have to worry about making it to your office during working hours and risk missing payments or being late to pay bills.

Want to learn more? Contact ID TECH!

If you’re interested in using pay and go kiosks, ID TECH has a range of options to choose from that are equipped with all the latest payment technology including: EMV card dipping, tap and go, or cash. Reach out if you’re still questioning whether or not your business would benefit from pay and go kiosks. Our dedicated and experienced team can help you make the decision that is best for your business.